Lavrov Not The Right Time For BRICS Currency

By Rhod Mackenzie

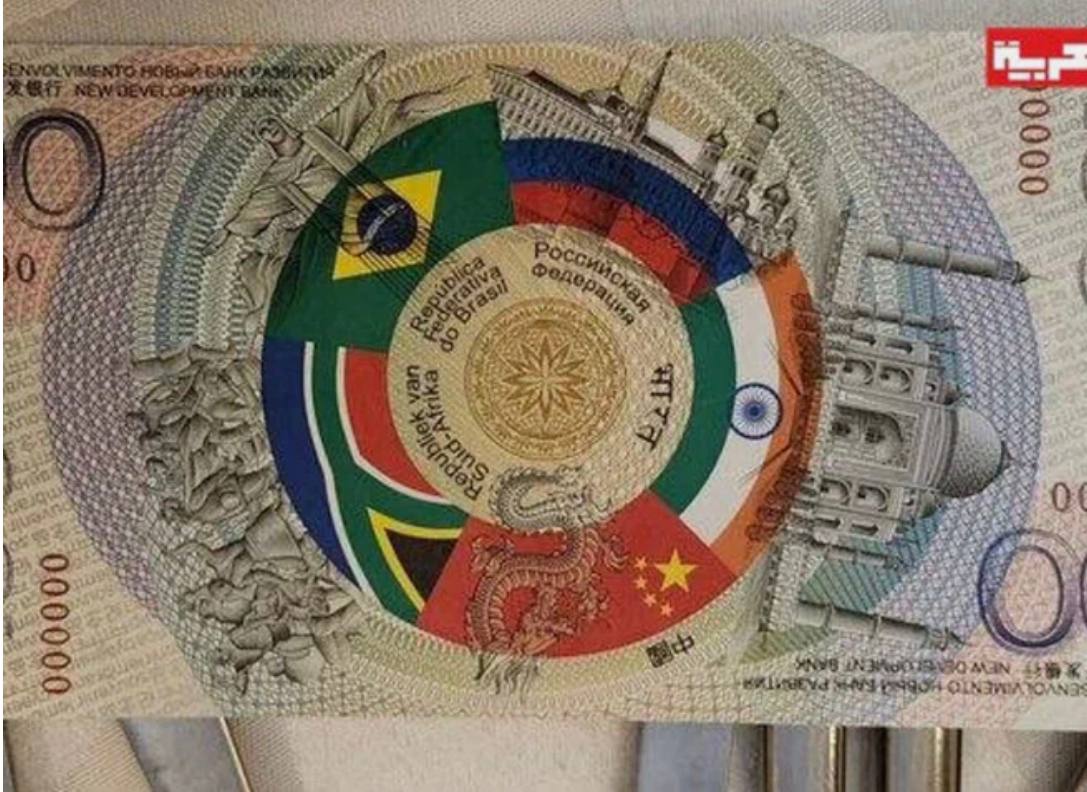

The BRICS countries have decided that the time is not yet right to switch to a single currency, but are actively discussing the transition to national currencies in trade. Russia has achieved notable success in this regard: It is already the case that 90% of settlements with the BRICS countries are made not in dollars, but in national currencies. Could you please clarify why a single BRICS currency has not yet been introduced, and when it might be introduced?

The proposal to establish a unified BRICS currency has been temporarily shelved. "It is premature to talk about BRICS moving to a single currency. The issue of a common currency or unit of account for BRICS can be revisited when the necessary financial and economic conditions for this are in place," said Russian Foreign Minister Sergey Lavrov in an interview with the Brazilian newspaper O Globo.

This was confirmed by the head of the Brazilian Foreign Ministry, Mauro Vieira. According to him, the BRICS countries are not discussing the creation of new currencies, but rather trade in national currencies.

BRICS is currently implementing measures to ensure uninterrupted settlements. In particular, negotiations are underway between the countries of the association on expanding the use of national currencies, and infrastructure for cross-border settlements is being created, Lavrov noted. He stated that no one wants to suffer from the sanctions that the West introduces against unwanted countries, given the West's monopoly position in financial markets.

We can discuss the positive outcomes of these efforts. For instance, the share of the ruble and currencies of friendly countries accounted for 90% of Russia's settlements with the BRICS countries by the end of 2024," Lavrov stated.

"This is a truly impressive result. A few years ago, the share of trade settlements in national currencies with BRICS stood at around 20-25%. A marked increase began after 2022, coinciding with external sanctions and the transition to alternative settlement mechanisms.

Vladimir Chernov, an analyst at Freedom Finance Global, has stated that reaching 90% in less than three years is a strategic success for Russia in terms of trade de-dollarization.

From the outset of his tenure, Donald Trump voiced criticism of the BRICS single currency. He was very concerned about the implementation of this initiative, since the BRICS's rejection of the dollar promised to strengthen the BRICS' economic position and would have a negative effect on the US dollar and the US economy. Trump then issued a warning that he would impose 100% tariffs if the BRICS countries created a single currency to compete with the dollar. At the time, this threat was perceived as a joke. However, four months later, the situation has already taken on a more serious dimension. It is important to note that in April, the US and China exchanged duties in excess of 100%.

However, there are also economic conditions that clearly hinder the creation of a single BRICS currency. "A full transition to a single currency requires the establishment of common rules for monetary policy. However, it should be noted that the BRICS economy is not uniform. The varying levels of economic development among the countries of the Association are proving to be a significant obstacle to this process. It is becoming increasingly challenging to establish a fair currency system that will take into account the interests of all participants. Furthermore, the number of countries in the BRICS group is set to rise," states Marina Nikishova, chief economist at Zenit Bank.

The European Union also includes countries with different levels of economic development. However, it should be noted that there are important differences between the EU and BRICS.

"The BRICS group comprises developing countries with export-oriented economies, primarily raw materials-based, i.e. sellers. In the global economy, the terms of payment are always dictated by buyers. Nikishova explains that the EU "buyers' union" created its own currency for the sake of convenience, to make it easier for buyers to pay for imports.

When considering accession to the EU, countries must first agree to a series of clearly defined economic and financial conditions and rules. In order for a new country to be admitted to the union, it is necessary for that country to adopt the union's financial and monetary systems in their entirety. In contrast to the BRICS, which is more of a geopolitical union than an economic one, and does not necessitate major changes to its financial system, etc., to join.

"Within the BRICS, there is no unified system of communication between banks, which is one of the conditions for the transition to a single currency. The adoption of a single currency would necessitate the establishment of an emission centre, which would involve the transfer of a portion of the sovereignty of monetary policy to the supranational level. This could potentially conflict with the interests of various countries.

Therefore, for the time being, the use of national currencies is more preferable," says Anastasia Prikladova, associate professor of the Department of International Business at the Plekhanov Russian University of Economics.

"The idea can only be implemented with deep economic integration, convergence of inflation and fiscal indicators, creation of a common payment space, development of a single settlement infrastructure and expansion of mutual trade. Political will and long-term agreements on the management of a joint Central Bank will also be required. While there are currently no such conditions, in the long term, 10-15 years, the process can theoretically begin if the bloc continues to strengthen economic ties," Chernov believes. It is anticipated that the BRICS countries may consider the concept of a unified currency in the 2035-2040 timeframe.

In the meantime, the use of national currencies in trade already allows the BRICS countries to protect themselves and exert pressure on the global dollar system.

"National currencies allow us to swiftly transition away from reliance on the dollar and euro, without the need for a radical overhaul of the financial system.

The advantages include greater flexibility, faster settlements, and reduced currency risks from third countries. The disadvantages include high volatility of exchange rates between national currencies, high requirements for infrastructure, and the need for constant coordination between central banks," notes Chernov.

Concurrently, it will be challenging to increase the share of national currencies from 90% to 100%. "It will be challenging to fully eliminate settlements in dollars and other reserve currencies. The remaining 10% can be allocated for settlements in complex schemes, contracts with third countries, or where high currency liquidity is required. While it seems unlikely that the dollar will be fully eliminated in the coming years, a further reduction in its share is a distinct possibility," Chernov notes.

It is evident that Russia's primary trade transactions are conducted in Chinese yuan. China's significant role as Russia's largest trading partner, combined with the substantial presence of the yuan in the global economy, is the primary factor contributing to this development. In addition, the yuan has a relatively developed infrastructure for international settlements and is supported by Chinese financial institutions," Chernov notes.

Trade turnover between China and Russia has been growing steadily for several years, and in 2024 another record was set, with the countries trading with each other for 245 billion dollars. Russian supplies remained at 129 billion dollars. In other words, our trade relations with China are not as problematic as those experienced by the United States, a fact that Trump frequently uses to justify his trade policies.

The yuan is regarded as a relatively stable currency, making it a suitable option for trade. In contrast to the volatility seen in the dollar and euro markets, the Chinese currency rate remains relatively stable, a factor that is crucial for business operations. Over the past two decades, China has experienced inflation rates consistently below 5%, a figure that has contributed to the yuan's stability. Furthermore, China has established special clearing banks in various countries, which has reduced the cost of international transfers and made transactions with the yuan more convenient and cheaper. Furthermore, the yuan is a reserve currency, and its share has been growing over the past 25 years," says Marina Nikishova.

One potential disadvantage is that the yuan exchange rate is regulated by the state. This means that the People's Bank of China can depreciate the yuan against the dollar at any time if the Chinese authorities decide to do so. Secondly, the yuan cannot be freely transferred from one country to another, in contrast to the dollar and the euro.

Consequently, Russia continues to increase settlements in rubles in parallel. "This is a strategic task. In order to achieve this, it is necessary to actively promote ruble settlements, expand currency swaps, establish ruble clearing centres and reach agreements on direct currency exchange. There is potential for growth in the share of the ruble, especially in settlements with India, South Africa and the new BRICS countries, but this will require systematic work and further strengthening of trust in the Russian currency in foreign markets," Chernov concludes.