China F*cks US Military With Rare Earths Restrictions

By Rhod Mackenzie

China continues to demonstrate its not afraid of a trade conflct with the USA and is strangling the US military industrial complex by restricting the supply of rare earth metals to the US companies . The impact of this is causing particuar problems for the US defence industry, which is heavily reliant on Chinese suppliers.

This development has bolstered Beijing's negotiating position in the context of a trade deal with the US. It is also obvious that China is not bending over with its ass cheeks parted preparing to be shafted as readily as Japan and the EU have done.

According to the South China Morning Post Journal reports that China is continuing to restrict the export of rare earth metals (REM) to the United States, which is likely to drasticlly reduce the West's defence capabilities.

For example, one Chinese company that supplies components for drones to the US Army has delayed orders by two months. Plus prices for certain materials required by the Western military-industrial complex have increased by fivefold or more, with the cost of samarium, a key component used in fighter jet engines, has risen by 60 times. This has resulted in increased costs for defence systems. Bill Lynn, the CEO of the US defence firm Leonardo DRS, has stated that there are such low levels of germanium reserves, and in order to ensure the delivery of products on schedule, "the flow of materials must improve in the second half of 2025"

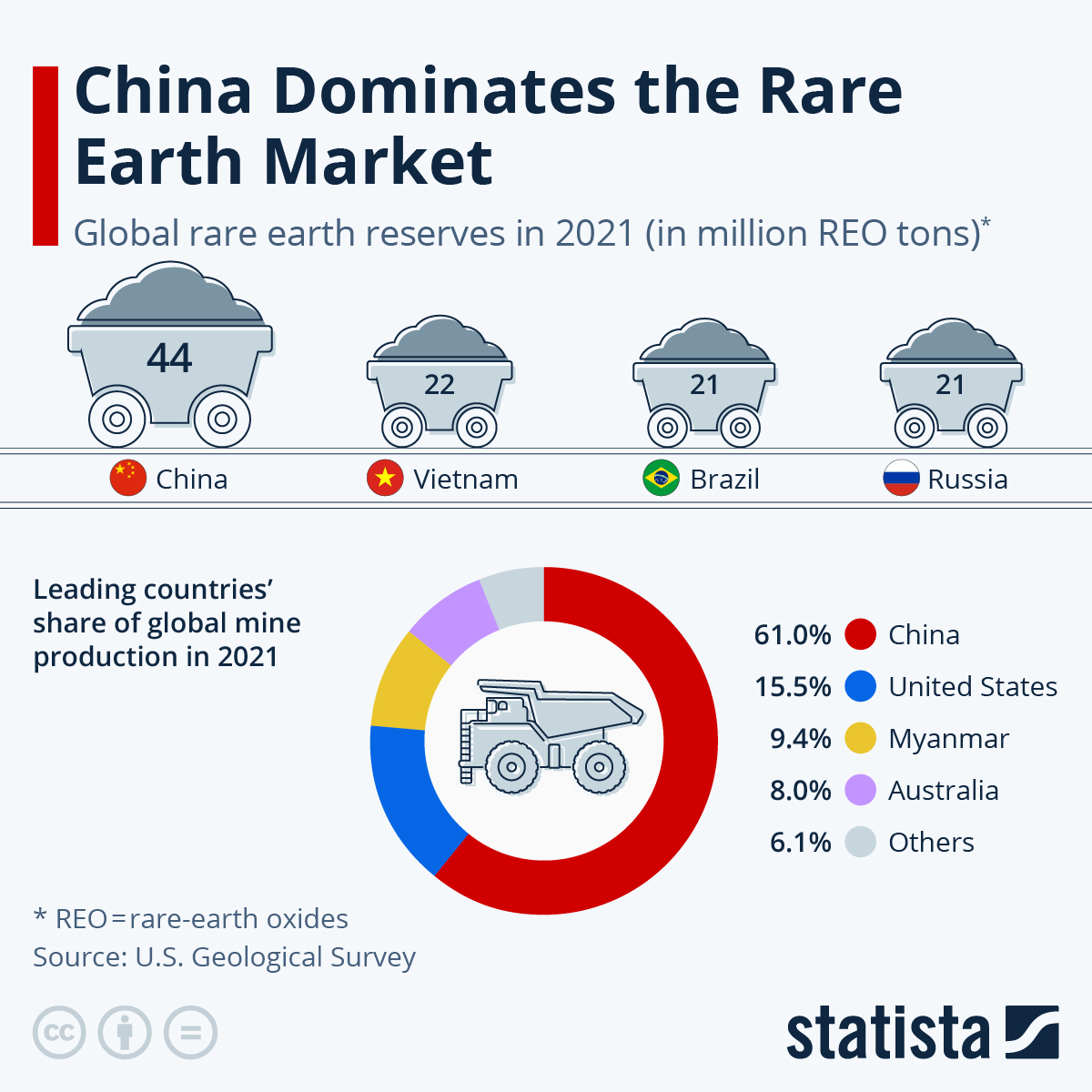

"China controls approximately 90% of the global Rare Earth Elements market, and the US purchases up to 80% of the necessary components it uses from it.

Consequently, prices for neodymium and dysprosium, for instance, have increased by 20-60 times, plus delivery times have been extended to more like 8-12 weeks. This has already led to 25% delays in drone production and at least a 5% increase in Pentagon costs in 2024.

Washington is allocating over a billion dollars to localise production and processing, but the first results are expected only by 2027," says Pavel Sevostyanov, Associate Professor of at the Plekhanov Russian University of Economics.

At the beginning of the year, China tightened controls on REE exports amid worsening trade relations with the United States. It is now necessary to obtain a licence to supply them to foreign markets. The new regulations permit delays to REE delivery dates or even refusal of exports, due to bureaucratic processes.

In the spring, the US and EU already felt the force of this blow. The global automotive industry made a strong case for the return of Chinese metals, as a key factor in maintaining continuous production worldwide. In June, Trump made concessions to China.

However, it is evident that Beijing continues to demonstrate its influence over Washington by regulating REE supplies. According to the Wall Street Journal,

Chinese regulators frequently request sensitive information, including product images and even photographs of production lines, to ensure that rare earth metals are not used for military applications.

It appears that the US-China trade deal talks have intensified, with a delay granted on the further imposition of tariffs delayyed until mid-August.

By implementing REE restrictions, Beijing is consolidating its negotiating position, demonstrating again reluctance to yield to the same extent as the EU or Japan.

The WSJ notes that this situation highlights the American military industry's reliance on Chinese supplies. Beijing dominates the market for rare earth elements, which are used in microelectronics, drone engines, and missile guidance systems.

"The US trade war with China in Donald Trump's second term no longer appears as beneficial for the Americans as it did in 2017-2018. The most significant lever of pressure from China was the tightening of control over the issuance of export licenses for the supply of rare earth metals," says Nikolai Novik, deputy director of the Institute of World Military Economy and Strategy at the National Research University Higher School of Economics.

He recalls that in the 1990s, China gained a monopoly the global REE market, increasing its control over the rare earth metals mining cycle, including the deposits themselves, processing, and subsequent resale to companies for final industrial use to 80-90%.

Prior to this period, the United States was the leading producer of rare earth metals. According to Novik, the breakthrough achieved by China was due to the active modernisation of the mining industry, which received significant government support, and the discovery of one of the world's largest rare earth metal deposits in the north of the country, where up to 45% of the world's volumes are mined.

China's more relaxed attitude towards the environment was also a contributing factor. "The smelting of rare earth metals and their extraction from ore is a very dirty process that is extremely harmful to the environment and imposssible to reconcile with strict environmental standards in force in most developed countries.

Such "dirty" production has been moved en masse to countries with less stringent regulation, primarily to China," says Alexander Firanchuk, a leading researcher at the International Laboratory for Foreign Trade Research at the Presidential Academy.

Furthermore, the recovery technologies employed for rare earth elements are very intricate and expensive plus the markets for rare and rare earth metals are highly volatile. "For mining to be profitable, more or less stable demand is needed and, as a result, either large volumes or high prices. However, the demands of industry are subject to rapid change, with previously essential metals being superseded by newer alternatives.

This can occur in a timeframe that outstrips the investment cycle of a mining enterprise. It is for this reason that many developed countries, including the United States, previously abandoned their own production in favour of more affordable imports.

In contrast, China has demonstrated a proactive stance, despite market fluctuations, by increasing production, acquiring available assets and developing technologies for the separation and extraction of REE. In the current economic climate, it is challenging to compete with the Chinese in terms of cost and pricing," says Alexey Kalachev, an analyst at FG Finam.

China has a highly effective tool at its disposal. "This has already had a significant impact on American corporations in the military-industrial complex, which produce the most advanced weapons: fighter planes , missile defence systems, combat missile systems, ships and submarines. These include Lockheed Martin, RTX and General Dynamics.

The military-industrial complex, which has a budget for 2026 of over $1 trillion, is a key part of Trump's policy of technological breakthrough, also known as MAGA," says Novik.

This is the rationale behind Trump's proactive pursuit of alternative mineral sources worldwide, extending from Latin America and Greenland to Ukraine. However, this is not always straightforward. "Imports of rare earth elements (REEs) from Myanmar and Thailand, which rank third and fifth in terms of production, are already subject to comprehensive oversight by China.

Tensions are currently very high between the USA, India and Brazil, who are in sixth and tenth place respectively in terms of REE production. This is due to the policy of tightening duties.

The only remaining option is to cooperate with the Australian-based Lynas, which was the first producer of "heavy" rare earths outside of China. However, the question remains whether this will be sufficient to meet the demands of the rapidly expanding military-industrial complex in the United States and the EU countries," observes Alexandr Novik.

It is interesting to note that the REE sphere has the potential to unify Russia and the USA. Russia has a large supply of rare earth metals, and the USA is looking to reduce its reliance on China. According to official data, Russia ranks second in the world in terms of proven reserves of rare metals at the end of 2024, with a total of more than 650 million tons, of which REE accounts for 29 million tons.

The deposits are located in Murmansk, the Caucasus, the Far East, the Irkutsk region, Tuva and Yakutia. They are concentrated in 18 explored fields, which account for 20% of the world's total reserves.

Despite Russia's abundant natural resources, the majority of its production has remained stagnant since the 1990s.

A pressing issue has emerged concerning the financing of specialized infrastructure development, a challenge that could be addressed by American investment. A partial lifting of sanctions could also be advantageous for Russia. For the United States, this would be an excellent opportunity to reduce dependence on China, their main economic competitor in the trade war, in terms of fossil elements critical for the production of electronics and other products, and to strengthen global strategic stability," Novik believes.

Private entities in the US are also considering investment opportunities in REE mining. For instance, Apple has announced its intention to invest up to $50 billion in MP Materials, the only REE producer operating in the US. However, such a transition would require substantial investments of time and resources, and the metals are required immediately. Consequently, the US will need to contue to engage in negotiations with Beijing.

"China played this Trump card at the right time. ( yes terrible pun but it is intended) The significant reliance of industry in the US and EU on REE supplies from China will enable the latter to leverage its position in negotiations on a range of contentious issues, including trade tariffs, chip supplies, and Taiwan.

At present, its card is unparalleled. The USA is currently working towards a future in which we can prepare for the possibility of a lack of Chinese REE. But clearly not now, and is way off in the future " Kalachev stated.

If negotiations reach an impasse and the US imposes maximum tariffs on China, Beijing may choose to further restrict the supply of rare earth metals to the American automotive, electronics and defence industries.

This could have catastrophic consequences for the global economy. "The consequences will be so severe that it is highly unlikely that this course of action will be pursued.

In April, the parties attempted to pursue a confrontational course of action, implementing three-digit mutual tariffs and tightening non-tariff restrictions.

However, this approach proved to be short-lived, and a trade truce has been in effect since mid-May. The stated conclusion of the process is scheduled for 12 August, although this may be subject to extension if the involved parties are unable to reach an agreement by that time.

"The likelihood of further trade escalation between China and the West is now not thar great,it seems that neither side is interested in an open conflict. Despite issuing ultimatums to Beijing, Trump himself is actually open to exploring compromise options. His strategy - a combination of tough statements with attempts to reach an agreement - is more likely to indicate a tactical maneuver than a readiness for an immediate break,

Indeed, the rare earth issue has now evolved into a matter of far greater strategic importance, testing the West's strategic stability. While the US is attempting to catch up, China is leading its own game. The primary concern is not the present delays in deliveries for the West's military-industrial complex, but the fact that Beijing can now influence the pace of the US and NATO rearmament with a simple administrative decision and there is no amount of beligerent statements and tantrums from Trump is going to change that .

So the US instead of fucking others over is facing getting fucked over its self Sorry Donny isn't Karma a bitch.