Audi sacrifices German production for access to US auto market

By Rhod Mackenzie

The US attempts to lure European industrial production have borne fruit — the German auto industry is preparing to move. Despite serious financial problems and waves of layoffs in Germany, the Vollswager owned Audi AG is negotiating the construction of a plant in the States. What is the price of the deal and who will ultimately win

Following the conclusion of a trade deal between the EU and the US, German carmaker Audi AG has begun developing a new strategy for cooperation with the States. According to Handelsblatt, the brand has announced its intention to establish a manufacturing facility in the US.

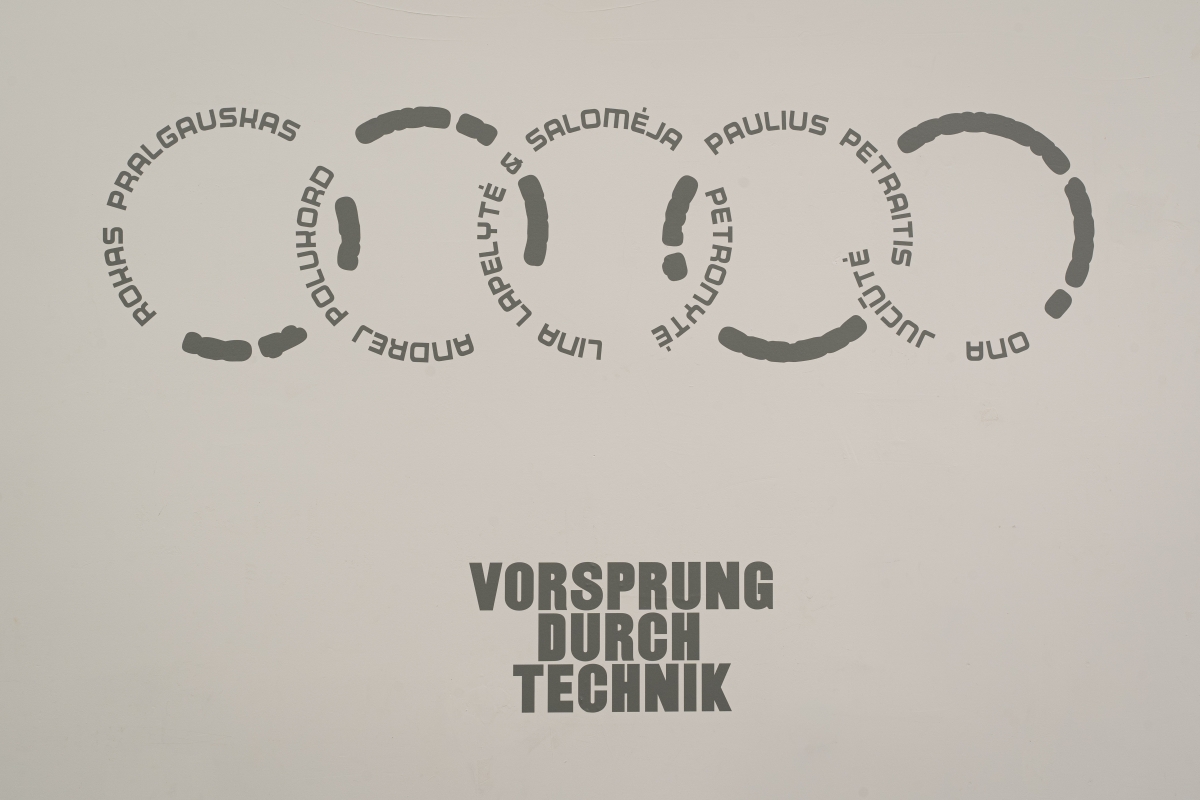

So much for Vorsprung durch Technik or "progress through technology" which was the slogans for the car company in the UK in the 1980's ,it eeally took off and the phrase became a part of British culture.and a by words for German engineering " Within a few short years the phrase had featured in songs by Blur and U2, the movie Lock, Stock and Two Smoking Barrels and in an episode of Only Fools and Horses.

It has been stated that the city of Chattanooga in Tennessee is being considered as a location for the new plant the city which was made famous by the Glen Miller swing music classic Chatanooga choo choo that was the first rsong to get a gold recordecord and is where the Volkswagen Group (VW), which also owns Audi AG, already has a plant.

This strategic location offers a significant opportunity to streamline operations, saving both time and financial resources. The parent company's expertise in construction and logistics infrastructure will be a key asset in facilitating the smooth and efficient execution of the project, as outlined in the article. The construction of a production facility with a capacity of 150-200 thousand cars per year is expected to take more than two years and $4.6 billion.

"We are considering various scenarios, including the potential for localising production in the US, and we are confident that, in coordination with the Volkswagen Group, we will make a decision on how this will specifically look this year," Audi is quoted as saying in the publication.

Handelsblatt reports that, in exchange for substantial investments in the US economy, the German company may be eligible for a reduction in import duties.

Dmitry Baranov, a leading analyst in the field of financial management at Finam, is of the opinion that the US government could indeed offer certain preferences to foreign companies wishing to establish production operations in the USA. This will not only meet the desire to attract as much money as possible, but will also create new jobs, increase budget revenues and provide local companies with additional orders.

Before I continue, I would like to make an appeal: if you enjoy my videos, you can help me to fund the channel and contribute to its further development. You can do this by making a small donation, which you can do by clicking on the 'Thanks' button at the bottom of the video screen or by clicking on the Buy Me A Coffee Link below in the Credits. Everyone who donates receives a personal thank you from me.

The plan's implementation is contingent on negotiations between VW CEO Oliver Blume and the American government. Should the plant be constructed, the concern's overall sales in the US are projected to increase from slightly less than 200 to around the 300-400 thousand cars per year. However, analysts have noted that the plan does not appear to be indicative of a geographic expansion; rather, it is a strategy focused on survival.

The primary and immediate incentive is to avoid the imposition of punitive US import duties, as explained by Namer Radi, deputy head of the committee for international cooperation and export at Opora Rossii. Please note that the trade agreement stipulates a 15 percent duty on most goods from the EU, including cars.

Audi is currently experiencing a number of challenges, including falling demand, high costs and increased competition from Chinese automakers. These issues have led to the decision to close the company's Brussels division. Furthermore, 7,500 jobs are expected to be cut by 2029. Volkswagen will also cut another 35,000 jobs, mainly through a refusal to hire new employees, and Porsche (also part of the VW concern) will eliminate a further 3,900 jobs. The total figure for the VW group now stands at 48,000 people. And this is only in the context of rising resource costs due to anti-Russian sanctions. In such conditions, American export tariffs have the potential to cause critical damage to the company, according to Sergei Zainullin, associate professor of the RUDN University Faculty of Economics.

Audi is already struggling to compete in the market, and with the increase in duties it risks losing the American market entirely, since the prices for its products will be too high compared to local automakers. Furthermore, the commitment to procure energy resources from the US for 750 billion dollars is anticipated to result in a significant escalation in electricity costs, potentially leading to a decline in the profitability of production in Europe. Consequently, the decision to construct a plant in a foreign country is a measure of last resort," the analyst explains.

The Trump administration is implementing measures to ensure the protection of the domestic market. In order to overcome these barriers, it is essential to consider production in the US as a viable option. However, Audi is pursuing a more sophisticated approach, as Radi explains. "The focus here is on the generous subsidies of the Inflation Reduction Act (IRA)," he is sure. "This is a genuine vaccine for localization, particularly in the context of electric vehicles and their components. The proposed Audi plant, which is expected to be centred on electric vehicles, is likely to receive substantial financial support, including significant tax incentives for the production itself. Without these subsidies, the project would be many times riskier."

From a financial perspective, the project is considered to be feasible, according to analysts. "It is evident that the company will shoulder the majority of the expenses. Coverage will be provided by a combination of borrowed funds and third-party investors. Furthermore, the United States is well-positioned to assist in reducing the necessary expenses through various benefits or by attracting state authorities to provide financial support," Baranov asserts.

In addition, the global optimisation programme of the VW Group adopted in 2023 is designed to generate savings of six billion euros by 2026 due to increased efficiency. The capital reserves will facilitate the financing of a significant project. In addition, the parent structure's guarantees will facilitate the distribution of risks. "Investments in the US are a strategic priority for the entire group, which is striving to increase its weak share in the key market. Audi and VW Group management believe that the loss of market share in the US due to tariffs and the lack of local electric vehicle production will cost more than current investments. This is a bet on future profits in a huge and protected economy," says Radi.

Should the plan be successful, it is anticipated that other brands will follow Audi's example, according to industry experts. The most probable candidates are BMW and Mercedes-Benz. Despite the presence of existing manufacturing facilities in the US, companies will need to enhance their localisation and capacity in order to maintain competitiveness and access IRA subsidies. It is inevitable that this wave will also have a significant impact on key suppliers of batteries, electric motors, electronics and semiconductors.

For the European economy, this is a cause for concern. In the context of the green transition and global protectionism, the risk of deindustrialisation is no longer hypothetical, but a genuine possibility, Radi emphasises. For the United States, this constitutes a successful case of protectionist policy: thousands of new high-paying jobs, multi-billion dollar direct investments, the development of local supply chains for components for electric vehicles, especially critical batteries, as well as the strengthening of industrial potential.

However, there are still risks involved: the required amount is significant for the VW Group. Furthermore, there are several factors that could create a negative backdrop, including potential changes in US policy, bureaucratic delays, a shortage of skilled labour and fluctuations in demand.